It usually starts with a financial emergency. You need ₹5,000 urgently. You search the Play Store for “Instant Loan,” download an app with a generic name, and within minutes, the money is credited to your account.

But 6 days later, the nightmare begins.

You receive a WhatsApp message: “Pay ₹8,000 now or we will send your morphed photos to your contact list.”

This is the 7-Day Loan App Scam. These are not banks; they are data-theft rings operating illegal call centers. They don’t want interest; they want to extort you through public humiliation.

In this CSNR Cyber Awareness guide, I will tell you exactly how they operate and, more importantly, how to make the calls stop.

The Mechanics: How They Stole Your Data

When you installed that loan app, it asked for permissions. You clicked “Allow” on:

-

Contacts: They uploaded your entire phonebook to their server.

-

Gallery: They gained access to your photos (used for morphing).

-

SMS: To track your other bank transactions.

Once you miss the payment (or even if you pay), they start calling your parents, boss, and friends, claiming you are a criminal or a defaulter.

Scammers use similar psychological tricks in job offers too. Read about the Telegram Prepaid Task Scam to recognize the pattern.

My Opinion: The Truth About “Repayment”

I have analyzed hundreds of these cases, and here is the hard truth that no recovery agent will tell you.

My Verdict: Do NOT Pay.

I know this sounds dangerous. You think, “If I just pay the ₹8,000, they will leave me alone.” They won’t. These apps operate on greed. If you pay once, they mark you as a “Soft Target.” They will claim the payment “failed” or demand a “Server Update Fee.” They will continue to blackmail you until you are bankrupt.

The only way to win is to cut off their power. You are not a defaulter; you are a victim of cyber extortion. Do not feel guilty.

Step-by-Step: How to Stop the Harassment

If you are currently receiving threats, follow these steps immediately. Do not skip any.

1. The “Factory Reset” (Critical)

The app is likely spyware. Even if you uninstall it, it might have left hidden trackers.

-

Backup your Photos and Documents only.

-

Factory Reset your phone completely.

-

This ensures they cannot steal new data or live location.

2. The “WhatsApp Switch”

Recovery agents rely on WhatsApp to send threats.

-

Go Offline: Uninstall WhatsApp for 4-5 days if possible.

-

Change Privacy: Set your Profile Photo and Status to “Nobody.”

-

Reject Unknown Calls: Install an app like Truecaller and set it to “Block numbers not in phonebook.”

If they can’t reach you, they move on to the next victim within 48 hours.

3. The “Pre-emptive Strike” (Damage Control)

This is the hardest part, but you must own the narrative. Send a message to your close contacts/status: “My phone was hacked, and my contact list was stolen. If you receive any rude messages or strange photos claiming I took a loan, please block and report them. It is a scam.”

By admitting you were “hacked” (which is technically true), you kill their leverage. The blackmail only works if you are scared of people finding out.

4. File a Complaint (RBI & Cyber Crime)

These apps are illegal. They are not registered NBFCs.

-

Report the app using the Google Play Report Form so they get taken down.

-

File a complaint at CyberCrime.gov.in under “Online Harassment.”

-

Report the specific company to the Reserve Bank of India using the RBI Sachet Portal, which is designed for illegal money-collecting schemes.

How to Identify a Fake Loan App?

Before downloading any lending app, check these 3 Red Flags:

-

No NBFC Partner: Every legal loan app MUST show the name of their RBI-registered banking partner. If it’s missing, it’s fake.

-

Generic Email: If their support email is

@gmail.comor@hotmail.cominstead of a corporate domain, run away. -

7-Day Tenure: Legal loans have a minimum repayment period of 90 days. Anything offering “7 days” is a trap.

Protect your financial data from future attacks. Ensure your banking passwords are secure with a tool from our Best Password Managers list.

You Are Not Alone

This scam thrives on silence and shame. Thousands of Indians face this every day. By refusing to pay and cutting off contact, you defeat them.

Stay strong. Clear your phone. And remember: Money lost can be earned back, but do not trade your peace of mind for an extortionist’s demand.

Our Analysis / Expert Opinion

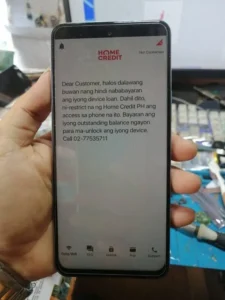

At CSNR, we reverse-engineered the APKs (installation files) of several banned loan apps to understand exactly how they blackmail users. We found that the “power” they hold over you is purely digital and based on specific permissions you unknowingly granted.

1. The “Contact Scraping” Mechanism

Most victims ask: “How do they know my uncle’s phone number?” Our Technical Findings: When you installed the app, it requested the READ_CONTACTS and READ_SMS permissions.

-

The Theft: In the first 30 seconds of opening the app, a script automatically uploaded your entire contact list and gallery metadata to their remote server (usually hosted in China or Southeast Asia).

-

Legit vs. Fake: A registered RBI lender (NBFC) checks your CIBIL Score via your PAN card. They never need access to your contact list. If an app asks for your contacts, it is 100% a scam designed for blackmail, not lending.

2. The “Morphing” Psychology

We analyzed the threats sent to victims. Expert Insight: The “Nude Video/Photo” threat is almost always automated.

-

The Reality: These scammers run “Morphing Centers” where they use basic Photoshop tools or AI to paste your face onto explicit images.

-

The Strategy: They rely on “Social Shame.” They know Indian society is sensitive about reputation. They don’t want your money as much as they want your fear.

-

Counter-Measure: The moment you stop responding and block them, you become “dead data” to them. Since they operate on volume, they usually move on to the next victim within 48 hours if they get zero engagement.

3. The “Cloud” Data Misconception

Does uninstalling the app save you? Our Assessment:

-

The Bad News: Uninstalling the app stops them from stealing new data, but it does not delete the data they already uploaded to their cloud.

-

The Solution: Resetting your phone is good for hygiene, but the most effective step is cutting off communication. Changing your WhatsApp settings to “My Contacts Only” breaks their ability to harass you, rendering their stolen data useless.

Final Verdict: These are not “Loan Recovery Agents”; they are Cyber Extortionists. You are not legally obligated to pay a single rupee to an illegal app not registered with the RBI.